Unlocking the Power of the Eight Financial Functions

Understanding and effectively managing finances is essential for any business’s long-term success. While many outfits already handle the topics of funding, record-keeping, and tax, owners may not be tuned in to other functions like wealth management, mergers & acquisitions, and audits & attestation.

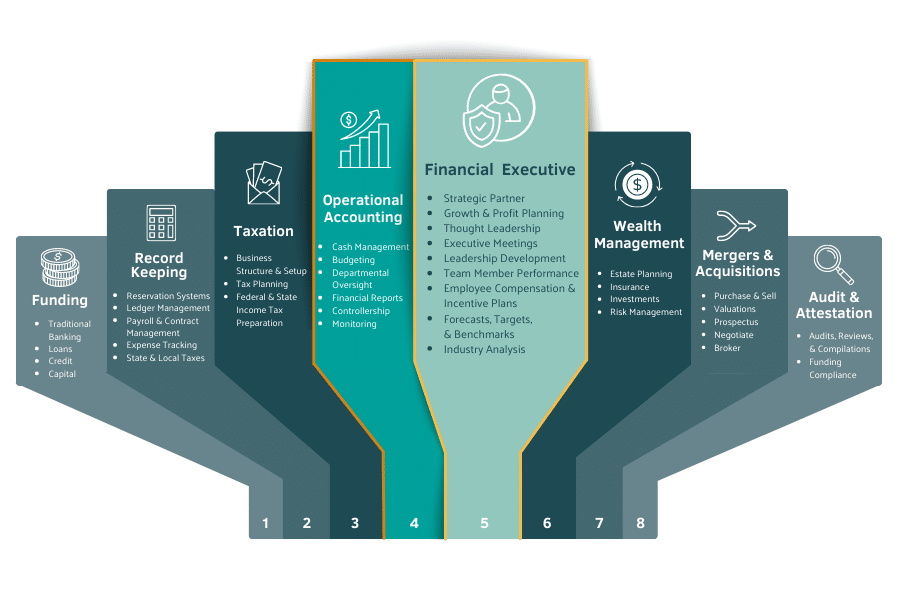

As businesses mature, so does the need for having a true financial executive at the helm. In this article, we’ll explore the eight financial functions outfitters often need, then dive deep into the untapped potential of numbers 4 and 5. By the end of this piece, it’ll be clear why Zebulon LLC is the ideal partner for outdoor outfitters seeking sustainable growth.

The Eight Financial Functions Outfitters Need

1. Funding

Securing the right funding is the lifeblood of any business, so identifying appropriate funding sources and developing robust funding strategies is the first crucial financial function.

Many outfitters are self-funded, boot-strapped, or considered “mom & pop” establishments that require minimal external funding. When needed, these outfitters lean on traditional banking to launch new ventures, open lines of credit, or take out personal loans so they can stay afloat between seasons or in turbulent times. Emerging and growing outfitters may receive outside investment, start-up capital, and/or expansion funds, although this is not as common in the traditional side of the outdoor adventure industry.

2. Record Keeping

Accurate and up-to-date record keeping is the backbone of financial management, so almost every outfitter already has some kind of bookkeeping process already in place.

Record keeping includes handling reservation and point-of-sale systems, ledger management, and payroll and contract management. Record keeping can also involve employee expense tracking (gotta make sure those company cards are put to good – and legitimate – use!), local and state taxes, ensuring compliance with post-use reporting, and other miscellaneous regulations.

3. Taxation

Navigating the intricacies of tax laws and regulations is imperative for business owners. Just a few of the tax-related to-do’s include business structure and set-up, tax planning, and preparing both federal and state income tax returns.

4. Operational Accounting

As a business grows so, too, does the complexity of its accounting requirements. Operational Accounting is where Zebulon LLC’s expertise starts to shine, and it just so happens to be one of the two main functions we rig up in our client relationships.

Don’t let the name fool you: “Operational Accounting” is a deceptively plain term that encompasses the thrilling world of cash management, budgeting, departmental oversight, financial reports, and profit analysis, and it encompasses much of what is considered controllership. Basically, when done well, Operational Accounting allows a company to take ownership of its financial processes. Operational Accounting also streamlines financial efficiency, maximizes profitability, and safeguards assets.

Important note: Zebulon doesn’t act as a full-blown controller for any of our clients, but we certainly do prioritize the biggest profit-driving aspects of operational accounting. These include setting financial targets, monitoring progress, and implementing innovative pricing structures.

5. Financial Executive

Financial Executives are executive-level team members, or external strategic partners, tasked with growth and profit planning, strategy management, leadership development, and so, so much more.

In larger corporations, financial executives are known as the VP of Finance or CFO (Chief Financial Officer). These leaders are the brains behind researching and adopting innovative practices, and the powerhouses responsible for all things that strengthen and grow a business financially.

Most growing businesses hope to receive “financial executive”-level services when they hire an accountant. Yet, they’re deflated when the accountant they hired delivers only traditional accounting, bookkeeping, or tax services. Nothing takes the wind out of an outfit’s sales faster than when a hired CPA does little to help owners grow their businesses.

Finding the Financial Sweet Spot

What these businesses really need is a Fractional CFO, which is our bread and butter here at Zebulon LLC. Zebulon LLC works with multiple outfitters nationwide, providing our clients with elevated industry knowledge and timely copy-paste innovations not available with in-house financial executives.

We’ve designed our services to sit in that sweet spot between needing more than just traditional accounting services and needing a full-time CFO. By serving as an “executive for hire,” we bring C-suite expertise and strategic financial guidance to the table, at a fraction of the cost of a full-time CFO. (For context, typical CFO compensation rates ranged between $300,000 and $500,000 per year back in 2021.)

Like any other executive-level position, a key component of the Financial Executive revolves around people: developing, training, growing, and otherwise doing everything possible to support your team. As such, one of Zebulon’s specialties at the financial executive level is our tailored leadership training initiative.

6. Wealth Management

Building and preserving wealth is a strategic imperative for business owners – but you already knew that. Some of the key components that fall under the “wealth management” umbrella include estate planning, insurance, investments, and even risk management.

7. Mergers & Acquisitions

Mergers and acquisitions take place when an owner purchases or sells their outfit. Many growing outfits will also merge with or acquire other outfits to expand their permits, capture market share, and grow their bottom lines. Merging with or acquiring other businesses requires specialized financial knowledge and due diligence.

It’s imperative that outfitters hire both accountants and attorneys who specialize in mergers and acquisitions, often on a project-by-project basis. Valuations, prospectus, negotiations, and brokering are just a few of the functions common in the M&A world.

8. Audit & Attestation

Not all outfits will need to undergo an audit or purchase attestation services. If an outfit is sold, however, it is often done so out of necessity and this process includes audits, reviews, compilations, and other reporting services performed by external Certified Public Accountants.

The National Parks, for example, require concessioners to undergo annual external financial audits. Outfitters may opt in to undergo a financial audit for their small ESPO plan, providing both accountability and financial transparency to their shareholders.

Fun fact: Audit & Attestation services are the only accounting services that require a CPA license. Not all businesses or individuals need audits, reviews, or compilations, though, so the vast majority of CPA firms use tax services to generate most of their revenue.

Empowering Outdoor Outfitters with Zebulon LLC’s Expertise

Now that you know the eight financial functions every business needs, which functions should you prioritize as an outdoor outfitter?

Industry-Specific Solutions for Sustained Growth

Outfitters often find themselves in a unique financial landscape, and we know you’re no strangers to navigating seasonal demands, fluctuating revenues, and specialized expenditures – all things that require specialized financial solutions.

Zebulon LLC’s services are finely tuned to accommodate the specific needs of outdoor adventure businesses, and by being the go-to financial executive with extensive outdoor adventure industry experience, we give our clients a truly competitive edge.

From uncovering profit to setting targets during off-seasons, to implementing and monitoring performance metrics in-season, to building-up accountable and business-savvy leaders, Zebulon LLC empowers outdoor outfitters to achieve sustainable financial success.

Access to C-Suite Expertise without Full-Time Commitment

Realistically, hiring a full-time CFO is neither cost-effective nor an appropriate move for many outdoor outfitters. However, accessing expert financial guidance is still essential, regardless of your outfit’s size, revenue, market share, or growth plans.

Zebulon LLC offers the ideal solution as a true strategic partner and financial executive. We provide crucial operational accounting strategy, plus access to C-suite level expertise and industry-specific insights – all without the financial burden that comes with a full-time executive.

Through Zebulon LLC, outfitters gain access to a team of experienced executives who truly understand the intricacies of the outdoor adventure industry and provide personalized, proven strategies for sustainable financial growth.

Find Your Financial Executive

Just ask any of our clients: leveraging our expertise is a spectacular catalyst for unlocking untapped potential in your outfit.

By providing tailored solutions and putting a true financial executive on your side, we empower outfitters to navigate financial rapids with confidence, thus opening the door to sustainable growth and ensuring a prosperous future – no matter the economic climate.

If you’ve got questions about the 08 financial functions, drop us a line here. If you’re ready to join the ranks of proactive outfitters with Zebulon as their financial executive, join our waitlist.

To keep your finger on the industry pulse, sign up for our newsletter or register for our bi-weekly Groover Gab – we’d love to have ya.