Case Study: How One Outfitter Improved Profits By Over $200k During Back-To-Back Economic Disruptions

A lot across the globe is changing. Business as we knew it is history. There is a new normal upon us and it is time we pivot, adjust, and make the most of it.

It’s time we get out of survive mode and into thrive mode.

How do we adjust? Where do we start? With so many unknowns, how do I get out of survive mode and into thrive mode?

These as the questions I’m helping business owners and entrepreneurs answer right now. Every situation is unique, however, there are targeted strategies you can implement to change your mindset and move from survive into thrive.

I could simply tell you these strategies. However, you will most likely dismiss them as “those don’t work” or you will put them in a to-do list for another time and never actually get to it. After all, let’s be honest, financial-specific initiatives tend to take a back seat to other ‘more important stuff’ promised to improve finances but never do.

So, I’m going show you how specific & targeted strategies helped one owner improve profits by $200k during two consecutive ‘shit’ years. Yes, we did this during years which the business’s local and state economies were severely compromised.

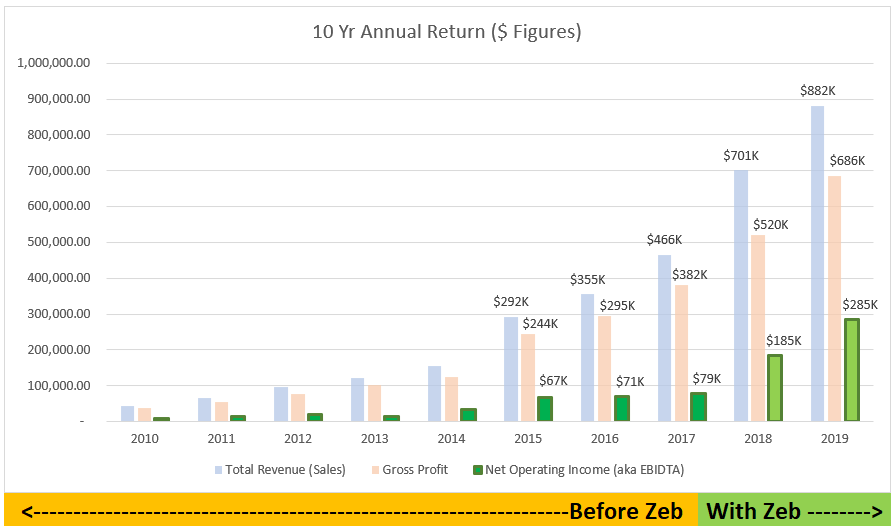

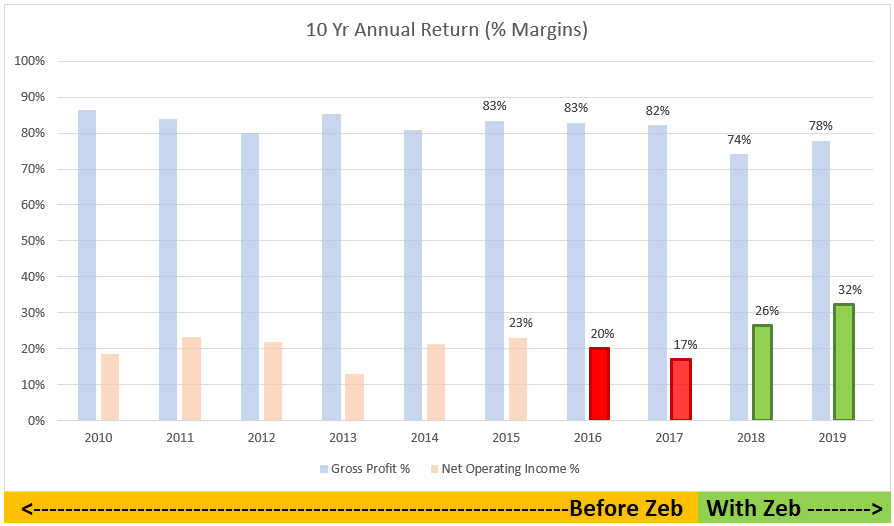

Below are a couple of graphs showing one business’s total revenue, gross profit, and net operating income for a ten-year period (2010 to 2019). The business is a tourism-based activity business that relies heavily on winter snowpack and summer tourism. Just under half of this business’s revenue is generated during winter and spring breaks and the other half during summer break. In 2018, the local area endured a severe winter drought followed by a hellacious summer-long fire season that crippled state-wide tourism. In 2019, El Nino brough record-breaking snow levels resulting in an avalanche that shut-down the single highway in and out of this little mountain town. This avalanche hit before spring break and the road didn’t open until early summer. The business endured not one but two consecutive years-worth of major disruptions. Both of which could have put him out of business!

So how did we generate an additional $200k in profits during these disruption-impacted years?

Well, he was super fortunate to have hired me mid-year 2017 prior to these disruptions taking place. At the time, I was hired to help with recordkeeping. Little did he know we were going to drastically improve his profitability and keep his business alive the next couple of years.

Gross Profit Margin and Net Operating Income Margin are two of the key metrics we benchmarked and improved in 2018 and 2019. You can see here, that despite this steady increase in sales and stable gross profit margin, the business’s net operating income margin declined in 2016 and 2017. This is called a diminishing ROI. Had we not made the below changes; this diminishing ROI would have severely impacted the business during the disruptions. Also, this is often why owners feel they are working harder (sales growth) but financially things are not improving (profit, owner pay, etc).

Here’s the year-by-year playbook:

- Mid 2017 – Improved recordkeeping efforts. What isn’t being tracked can’t be improved.

- Late 2017 – Reviewed historical key financial metrics & set benchmarks to pursue.

- Late 2017 – Renegotiated with key vendors to best leverage their strengths & eliminated unnecessary spending.

- Early 2018 – Set-up bank accounts to protect profit, owner pay, tax savings, & reduce spending. What’s not available to be spent can’t be spent!

- Early 2018 – Standardized job duties. Itemized the different tasks performed by various employees and centralized job duties. Looked at current employees and matched employee strengths to the right jobs. Moved two employees from hourly to salary. The employees were stoked! Improved pay and job security!

- Mid 2018 – First Disruption: Monitor & Adjust. Kept a close eye on finances, kept heads on a swivel for sales opportunities, leveraged employees, and continued to negotiate with key vendors & best leverage their strengths.

- Late 2018 – Recovered from disruption. Used money accumulated in the profit bank account to pay down debt.

- Late 2018 – Evaluated financial health, re-benchmarked key financial metrics, reviewed spending for additional saving opportunities, etc.

- Early 2019 – Second Disruption: Monitor & Adjust. Kept a close eye on finances, kept heads on a swivel for sales opportunities, leveraged employees, and continued to negotiate with key vendors & leverage their strengths.

- Mid 2019 – A non-disrupted seasons! Hallelujah! Continued to keep a close eye on finances and made small changes to retain profits. Used profits to pay off debt and build cash reserves.

- Late 2019 – Evaluated financial health, re-benchmarked key financial metrics, reviewed for additional saving opportunities, etc.

- Early 2020 – COVID-19 hits. Well… We’ve seen this before. What do you think we are doing? Only this time there is no debt and we have cash reserves… So, we’re not too worried about things.

- Mid 2020 – Bring it COVID-19!

As you can see, disruption sucks but it isn’t the end of the world. You simply need to understand how a disruption will impact you financially; you need to know where to look for and best leverage opportunities; and you need to be ready to act when the rebound happens.

Today… We need to get out of survive mode and into thrive mode!

If you like what you see here and want my help navigating this disruption, then hit me up. I am an expert in this stuff (this is only one of many success stories). Let’s discover your opportunities and adopt financial strategies that will get you through this disruption.