One of the most important things an outfitter can do in the off-season is manage cash with intention. And, one of the simplest tools in an outfitter’s gear list is knowing where to store end-of-season cash to generate income – and do so passively – during the shoulder season!

High Yield Savings Accounts (HYSA’s for short), and the cash monies they provide, are an effortless way for outfitters to level-up the financial health of their outfit. Opening a High Yield Savings Account is a tried-and-true, set-it-and-forget-it way to earn money in your sleep. Really!

Side note: You won’t find any specific account or bank recommendations in this article, because which bank you work with is a highly personalized decision. That being said, don’t snooze on doing your own research to find the best HYSA for you! Meanwhile, we’ll use this space to hype up the more general, positive impacts of all HYSA’s.

Ready, Set, Launch!

Let’s take a look at the financial journeys of two theoretical outfitters, Grandpa Joe’s Old-School Outfit, and Modern Millie’s Savvy Paddlers.

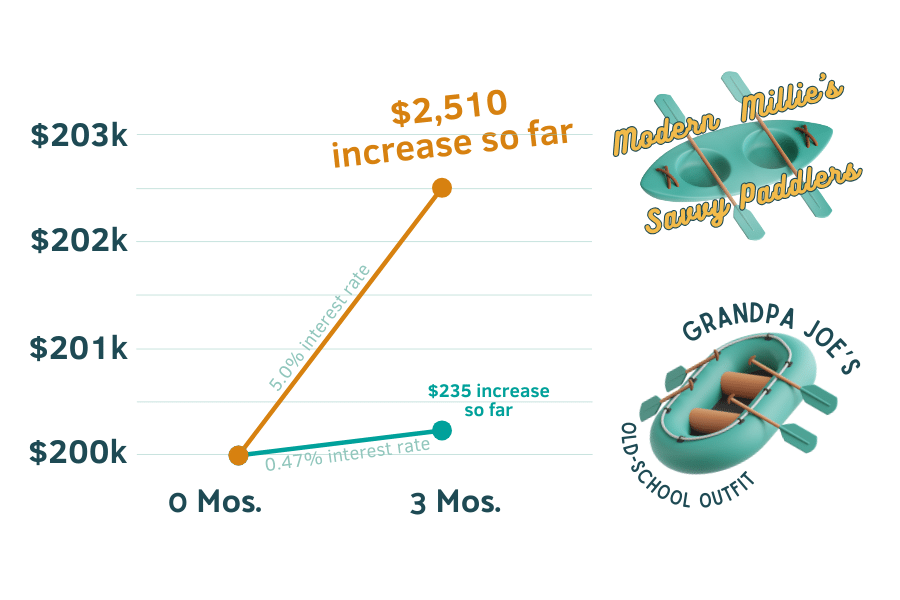

According to fdic.gov, as of January 2024, the average national deposit rate for traditional savings accounts is 0.47%. At the same time, many of the best High Yield Savings Accounts are offering anywhere from 4.25% to 5.25% APY (annual percentage yield).

So, let’s assume both theoretical outfitters had a rockin’ season last year. By the time the season wrapped in September, they were both sitting on a pile of $200,000 cash surplus. (This is even after squaring away their regular equipment and inventory re-stock purchases.) Way to go, outfitters!

Grandpa Joe decides to keep the Old-School Outfit’s cash nice and safe in the same traditional savings account he’s always used. He knows all $200k of it will be ready and waiting for him at the start of next season come March or April. Great idea, right?

Modern Millie is ready to actively harness the power of passive income. She does a little research and finds a bank that offers a 5.0% APY for her High Yield Savings Account. So, Millie moves all $200k of the Savvy Paddlers’ savings into her new HYSA account. It’s time for her to sit back and let her surplus go to work for her over the next few months.

Harness the Power of Compound Interest

In its simplest terms, account interest is what a bank pays its users as a “thanks” for keeping money in their bank.

Compound interest is calculated using both the principal (original amount) and the interest earned on previous periods. This means that any earnings are essentially reinvested every month – a great deal, especially if rates are higher. Compound interest is like hitting the jackpot of interest types, because your interest earns you even more interest!

If you’ve been paying attention to the economy recently, you’ve probably heard about interest rates creeping ever higher. This means things like mortgage rates are hovering between 7-8%. Ouch!

On the one hand, increased interest rates can translate to belt-tightening measures for consumers. But on the other hand, when mortgage rates go up, so, too, do High Yield Savings Account rates. This means potential earnings on cash reserve balances can increase. And in the outfitting world where seasonal cash flow can be a challenge, every additional dollar your bank account earns for you definitely reduces the burn in the off-season.

Seeing Returns On Your Savings

How are our two theoretical outfitters coming along?

Let’s assume half of the low season has passed (three months, from October through December). Grandpa Joe and Modern Millie each take a peek at their account balances to ring in the new year. Remember, they each started with $200k cash, yet only Modern Millie decided to put her reserves into a HYSA.

Using this compound interest calculator, we can see that Grandpa Joe has earned just over $76 in interest each month. So, after three months, he’s sitting on $200,235. Two hundred and thirty-five whole dollars!

However, Modern Millie is really raking in the cash. The first month alone she earned $833 interest! That’s over 10x what Grandpa Joe brought in. After three months, Modern Millie has earned a whopping $2,510 in interest, bringing her total account balance to $202,510. That’s $2.5k extra – not bad!

Feeling the Burn with Inflation

Not only are regular, low-interest accounts not earning you much passive income, but the double whammy right now is that they’re also affecting you negatively due to inflation!

Inflation in 2023 averaged 3.4%. This is quite low if you compare it to 2021-2022’s eye-watering levels of 7% and 6.5% respectively. However, an inflation rate of 3.4% is still considerably higher than the 2% sweet spot where economists generally agree inflation should sit.

Let’s consider 2023’s rate of 3.4%: if 2022’s spend totaled $1m, then those same costs went up by $34,000 in 2023.

Now, let’s return to our theoretical outfitters and see how 3.4% inflation affects the $200k left over from last season. Remember, Grandpa Joe’s cash is sitting in a low-interest savings account. So, the pesky punch from 3.4% inflation will cost him the equivalent of $7,400 next year. And that’s without earning hardly any passive income for the Old-School Outfit, to boot! Ouch!

Safe & Sound With FDIC Insurance

Something worth mentioning is FDIC insurance. The feds insure up to $250,000 per depositor, per institution. So, say you need to keep $50,000 per month in your checking to cover monthly off-season spend, and you have $200k in a High Yield Savings Account at that same bank. Good news: all of your money at that bank is insured by the feds.

If you need to keep more than $250,000 cash on hand with easy access to it, then you’ll want to consider splitting up the funds and depositing them across different institutions. This makes sure every single one of your hard-earned dollars is federally insured.

You may be asking yourself, “But Zebulon, is federal insurance really that important?” And our answer to you will be, “Remember the jaw-dropping headlines from Silicon Valley Bank in March ‘23?” Moral of the story: A financially healthy outfitter would be smart to stay within $250k insurance limits per bank. (And stick with FDIC-insured institutions!)

High Yield Savings are the Clear Winner

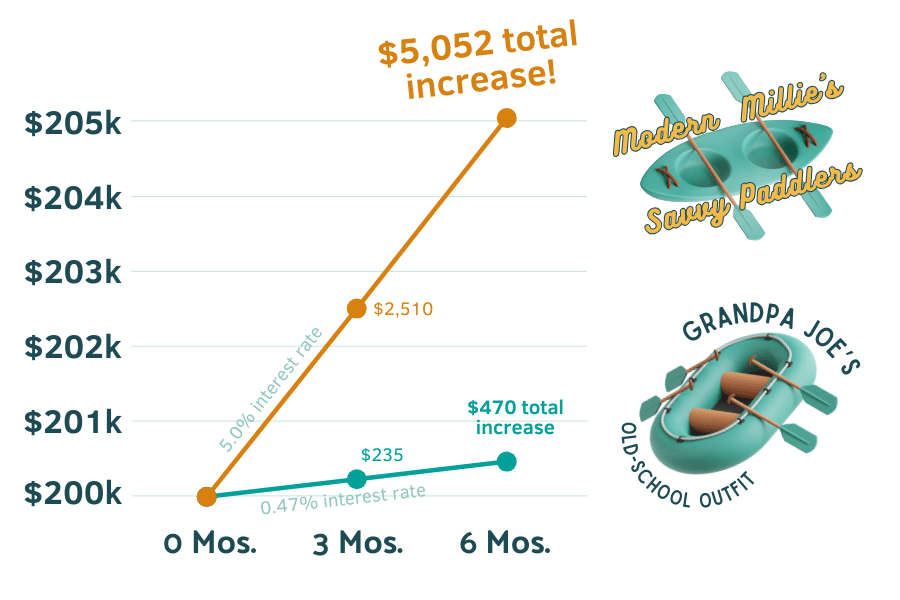

Let’s check back in with our theoretical outfits once more before the high season ramps up.

Let’s assume the full six months of the off-season have passed. (Side note: we’re confident that both outfitters made the most of their offseason by starting to train their leaders, educating their managers on their outfit’s financials, and building a robust email marketing strategy, as per Zebulon’s expert recommendations!).

Remember, both outfits started the low season with a nice $200,000. After half a year at a traditional interest rate of 0.47%, Grandpa Joe’s Old-School Outfit balance increased by $470. Not bad – until you realize that’s barely enough to cover a couple gallons of Sink the Stink wetsuit cleaner! Doh!

After half a year with an HYSA rate of 5.0%, Modern Millie’s Savvy Rafters’ balance increased by an impressive $5,052. Just imagine what you could do with an extra five grand to kick-start next season!

Easing Into a New Season with Your Passive Income

As new seasons approach, outfitters are accustomed to facing significant upfront expenses. You know the drill – you discover holes in rafts, the van’s transmission is on the fritz, or any other number of unexpected issues arise.

The passive income generated from a High Yield Savings Account – remember that healthy $5k earned in interest? – goes a long way toward start-of-season costs. A couple thousand dollars is a big help in smoothing out some of the pesky cash flow bumps that can pop up early in the season.

Being proactive with your savings ensures that your accumulated savings don’t just sit idle – or worse, shrink due to inflation!

High Yield Savings Accounts are an easy, no-fuss way to help outfits start the new season on solid footing. A healthy financial buffer can keep you from having to unexpectedly tap other resources, and that’s a win in our books!

If you’re ready to evolve from old-school to savvy in more ways than just opening a High Yield Savings Account, we’d love to explore working together. Otherwise, we hope you’ll join the Outside In-Crowd on Facebook, participate in our next Groover Gab webinar, or put your email down for our weekly newsletter.