As the summer crests the midpoint, outfitters from our nationwide network are reaching out to learn how other regions are doing. So, we sourced our network of current and past clients to gain insights on how the 2023 summer season is really progressing, resulting in this mid-season update.

Emerging trends we cover below include a shift in booking numbers and tendencies, weather challenges nationwide, whether the greater economy can be the scapegoat for any of this (spoiler alert: nope!), and a four-way fork in the road many outfitters face in the near future.

2023 Booking Trends: A Mixed Bag

As anticipated, outfitters are experiencing a change in both booking numbers and booking tendencies when compared with recent years.

In the Rockies, 2023 booking numbers have decreased compared to last year, with clear parallels to pre-pandemic numbers. However, the outfitters in Zebulon’s network are experiencing higher revenue numbers than prior to the pandemic, indicating a positive overall post-pandemic trajectory.

Colorado, a state that saw a bigger-than-usual pop during Covid, is now seeing a bigger-than-usual drop. Zeb’s calling it “Colorado’s hangover from the Covid high.”

As one Colorado outfitter put it, “Client numbers are lagging from ’21-’22 and tracking very closely to ’19 … my primary takeaway is I think we finally found our ‘new normal’ post-pandemic.” Similarly, an outfitter who operates in Idaho says, “The Middle Fork is down about 15% from last season and is maybe average for the 2016-19 timeframe.”

That being said, outfitters that operate outside of the Rockies, and whose weather is more cooperative, are seeing booking levels pretty much on-par with 2022 – numbers are still down from 2020 and 2021, but better than pre-pandemic.

Nationwide, advance day-trip bookings (those made more than a week out) are also down which, as we all know, makes scheduling and staffing tricky. Conversely, day-of and last-minute bookings have increased, but if you’re curious why the sudden increase …

Weather Woes in Colorado and Beyond

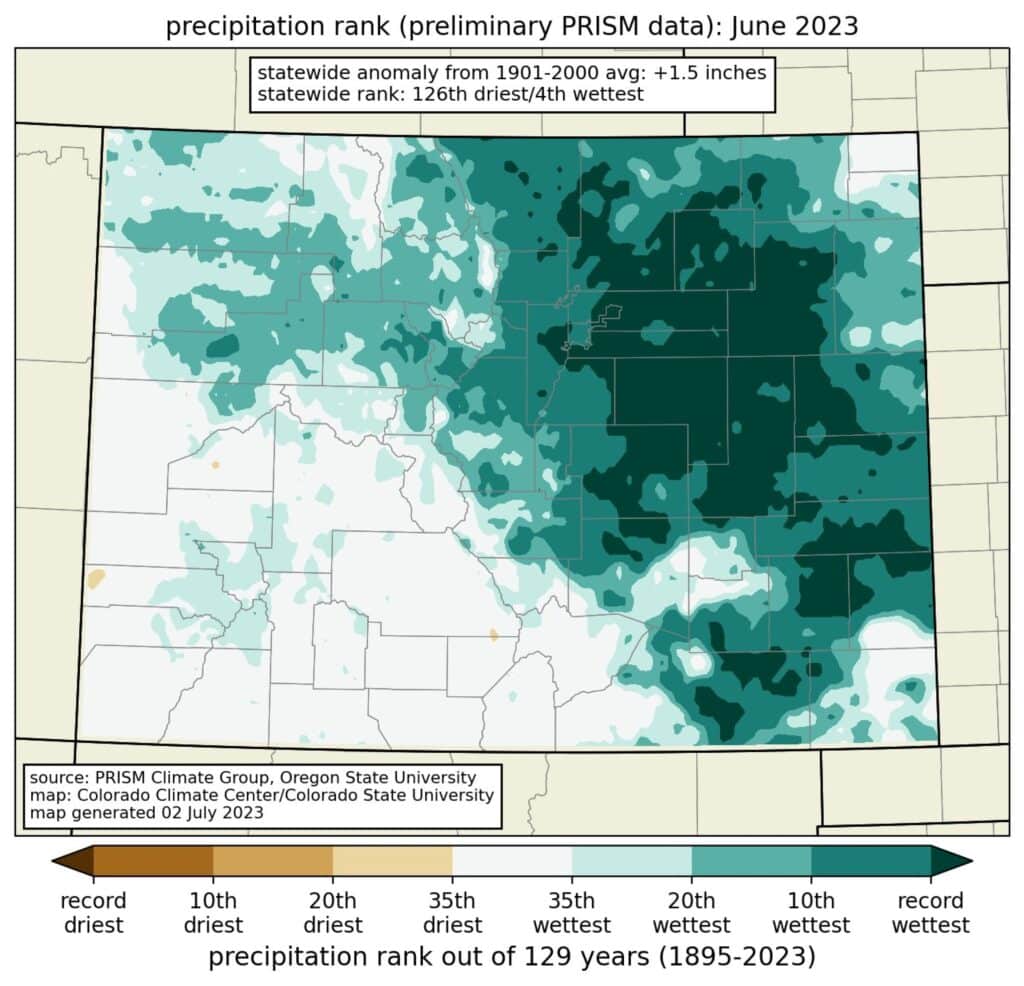

Regional outfitters in pockets across the nation are experiencing severely atypical weather (anyone else feeling the heat?). Those of you operating along the Arkansas River have faced significant challenges due to record-setting levels of rain – we’re talking dumping “an entire month’s worth of rain in two days” kind of record-setting.

They aren’t kidding when they say, “never been wetter.” (Source: PRISM Climate Group, via koaa.com)

Intense and unseasonable summer weather has negatively impacted outfitters’ abilities to secure bookings. With June’s higher-than-usual rainfall, outfitters have had to adapt their operations and marketing strategies to mitigate the impact of weather-related uncertainties, and thus are relying more heavily on last-minute bookings.

As one Colorado outfitter summed it up: “We’re getting lots of day-of and 24-hour-out bookings when it’s sunny, but we’ve gotten 90% of our annual precipitation since June 1.”

One New Hampshire Outfitter whose activity bookings are down an outstanding 85% – the largest drop we’ve heard so far – said simply, “Give me a drought.” Yikes! Send some of that rain to Canada, would ya? 😉

Understanding Trends: Looking Beyond the Economy

We know it can be tempting to blame mid-season pain points on the broader economic climate.

However, before you say, “It’s the economy’s fault!” I want to share with you some travel-related markers that demonstrate customers’ appetites are still hungry for adventure.

International Travel

International trips this summer have increased across the board, which is contributing to fewer butts in boats stateside. Our operators that also offer international excursions are showing strong numbers this summer. For some, this international income is covering their butts (or their drop in domestic butts, that is!).

Looking Ahead to 2024

The good news is we’re already seeing positive booking trends for 2024 domestic numbers. Lodging pre-bookings and higher-ticket multi-day excursions are curiously strong both in volume and revenue, influenced by Zebulon’s suggested pricing changes. This tells us that those traveling far and wide this summer are already planning on staying closer to home next year, and they’re willing to put money down for it now, which speaks loudly against many economic markers. Or perhaps smarter pricing structures are attracting new markets? Only data and time will tell!

Proactive Pricing

The bad news is costs are rising just as fast, if not faster, than the majority of the industry’s simple price increases. I’ve heard from numerous outfitters who are not Zebulon clients that their activity prices have gone up 25% or more since 2019, but their net profit is stagnant. If you’re in this boat, it’s time to try something different.

Remember: Broadly blaming “the economy” overlooks both the nuanced dynamics at play and the shifting preferences in the outdoor experiences industry. It’s also important to remember that current summer trends are most likely caused by factors like weather conditions and evolving post-pandemic travel preferences.

Zeb’s Takeaways

As the summer outdoor season keeps chugging along, it’s clear that outfitters are navigating a dynamic landscape. Stay diligent and reach out for a fresh set of eyes and creative thinking in the space. Our clients are moving against the grain on many fronts; customers and employees are noticing, and it’s paying off ten-fold.

For my Coloradans and non-Coloradans alike:

The hordes of people that flocked out west during Covid are now spending their money elsewhere, either local-to-home or internationally. The three main points supporting this are:

- Non-Colorado outfitter current-year booking numbers. For perspective: within our nationwide network, non-Colorado outfitters are doing just fine, whereas Colorado is comparatively down (except for one Colorado client who’s kicking butt thanks to innovative changes).

- Increased international excursion numbers. Our Zebulon clients’ international trip sales are up 20-30%, which is balancing out the drop in US trips for those select outfitters. However, this means our strictly-domestic outfitters are feeling the pinch.

- Higher-than-usual pre-bookings for multi-day excursions in 2024. Don’t worry, they’ll be back!

By reframing perspectives, stepping outside of the status quo, and recognizing the influence of weather and post-pandemic travel preferences, outfitters can strategically address the challenges they face, adapt their offerings, and proactively tap into emerging opportunities.

Up Next: The Four-Way Fork in the Road.

The way I see it, outfitters are currently facing a four-way fork in the road. The way ahead involves one of four options:

- Scaling up

- Scaling down

- Embracing innovation (we’re talking “beyond-the-status-quo” and potentially “against-the-grain” innovation here)

- Staying put and taking no action.

Yes, taking no action itself IS an action and, with what lies ahead, it’s one that will likely lead to an outfit’s slow and painful demise.

Changes in consumer and employee preferences play a significant role in shaping the demand for outdoor adventures. Understanding and staying ahead of these evolving preferences is key to remaining competitive and profitable. As you face this four-way fork in the road, it’s crucial that you proactively choose your path for the rest of the 2023 season and beyond.

If you’ve got feedback on the trends we’re seeing, or want to provide some extra insight, drop us a line here. If you’re ready to join the ranks of proactive outfitters who are innovating to stay ahead of the curve, join our waitlist.

To keep your finger on the pulse of more industry trends, sign up for our newsletter or register for our bi-weekly Groover Gab – we’d love to have ya.