Here at Zebulon, we believe knowledge is power. And, we’re big believers that a rising tide lifts all boats.

So, we amassed Q1’ 24 data from numerous outfitters nationwide – both clients and non-clients – and we’re happy to share the pre-season trends we’re seeing in this 2024 Scout Report.

Scout Report Data Sources

Our primary source of information comes from the clients we have on retainer with us, who are also members of The Eddy. Due to the nature of our working agreements with our valued clients, we maintain an intimate knowledge of many of the nation’s most innovative and growth-minded outfits. While it’s against our ethos to share specific client numbers, we’re happy to aggregate what we’re seeing and highlight some industry-wide trends.

We also reached out to our extended industry community to ask outfits to share Q1 ‘24 numbers. We received responses from members of the Outside In-Crowd Facebook group, discussed data during live Groover Gab Zoom sessions, and received numerous email exchanges from other industry movers and shakers.

We’re honored that so many people trust us with their preliminary season data and numbers, and we think this speaks volumes about the general goodwill of our industry. If you contributed your outfit’s data to this 2024 Scout Report, we’re grateful for you.

We’ll say it again: a rising tide floats all boats!

Shameless Plug: Don’t Snooze on The Eddy

Before we dive into the data, it’s important to shout out our Eddy leadership peer group. As soon as Q1 wrapped up, our Eddy members received exclusive access to everything we’re including below – and more.

We led a dedicated 90-minute special session for our Eddy members (consisting of outfit owners and their key managers who are on retainer with us). During this special session, we showcased individual outfits’ specific Q1 ‘24 numbers and discussed group trends and averages. We’re confident this next-level data analysis will have a positive impact on members’ outfits as they kickstart the 2024 season.

If you’d like to get early access to impactful data like this – among other massive perks – by getting on retainer with us and joining The Eddy, let us know.

2024 is a Mixed Bag

If you’re in a rush, and if you wish we’d just cut to the chase, here are our 2024 Scout Report findings condensed into one sentence:

Outdoor adventure industry bookings and projected income for ‘24 are a mixed bag.

However, regardless of being in a rush, you’d be doing yourself a huge disservice if you stopped reading after that sentence!

You’d miss the subtle theme that things were more or less stable until March, when everything started to split off (our industry’s own version of “March Madness,” as it were). You’d miss the significance of realizing that, while activity booking volume is generally down, lodging volume is consistently up across the board. You’d also miss out on learning that Zebulon’s clients on retainer are working toward an impressive 61% increase in Net Operating Income this year alone.

Wait, hold the phone. Really?

Read on to discover all this and more.

Scout Report Field Notes: Data specifics

In the Rear View Mirror

Let’s take a quick look at 2023’s numbers as compared to the previous year, 2022.

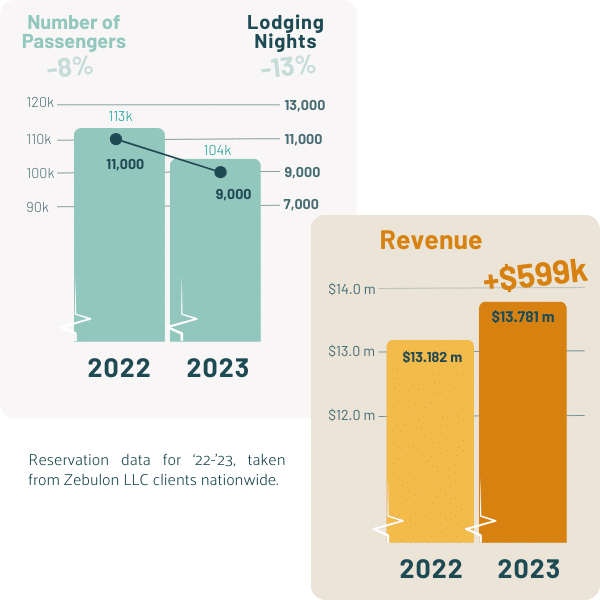

Overall, Zebulon’s clients served 113,000 passengers in 2022, and they experienced an 8% drop to 104,000 passengers in 2023. It’s important to point out that one industry behemoth, who signed on to work with us late in 2023, drove most of this drop. Otherwise, our “OG” client base that’s been with us for multiple seasons experienced just an aggregated 1% drop in passenger volume nationwide.

When it comes to lodging, Zebulon’s client’s lodged 11,000 nights in 2022, and experienced a 13% drop to 9,000 nights in 2023.

Despite the overall drops in volume from 2022 to 2023, our clients still made an extra $599k in revenue because of our pricing models. Not bad!

Lodging in 2024

Our clients with on-site lodging are reporting a mixed bag when it comes to overnight bookings for 2024, but things are generally trending positively.

Eddy-wide, meaning for our collective clients on retainer, we’re expecting lodging to be comparable to last year – or perhaps slightly better. Individually, our clients are expecting anywhere from a 5% to 25% increase in lodging nights.

In terms of pricing, we’re expecting an average $28 per night increase in lodging prices. This is an 11% increase over last year’s prices.

At the end of Q1 ‘24, lodging nights are up 21% compared to Q1 ‘23, and trending toward ‘22’s overall booking volume. This, mixed with the 11% price increase noted above, means we’re projecting each client will generate an extra $257k on average in lodging revenue!

As part of our due diligence, we subscribe to Inntopia’s DestiMetric Industry Wide portal. Inntopia sources lodging data from the West’s hottest ski resorts and mountain towns. DestiMetric reports a comparable quantity of room nights to the previous year, for both the 2023-2024 winter ski season and 2024’s upcoming summer months.

At this point, in regard to predicting 2024’s year-end, industry-wide lodging nights for the outdoor adventure industry, your guess is as good as ours!

Activities in 2024

The Eddy group is also seeing a mixed bag when it comes to activity numbers for the 2024 season. Overall, activity bookings were more or less stable heading into March. But, the last month of Q1 ‘24 is when numbers really started fluctuating.

Activity Volume

On our client roster, we’re seeing everything ranging from individual outfits expecting a 26% volume increase, to a 10% volume decrease. Both of these are extenuating circumstances, by the way. For the general populous, we are cautiously preparing ourselves for a 5-10% drop in passenger volume from 2023.

That being said, we’re not convinced this pre-season drop is driven by demand. Our theory is that we’re watching customers’ purchase behaviors reverting to pre-pandemic in-destination habits in real time. We believe this because Q1 ‘24 website traffic continues to exceed the previous year, despite high winds and unfavorable early season weather patterns. If our theory is true, then volume will eventually increase and 2024 should rival pandemic banner years. We’ve got our fingers crossed!

Activity Pricing

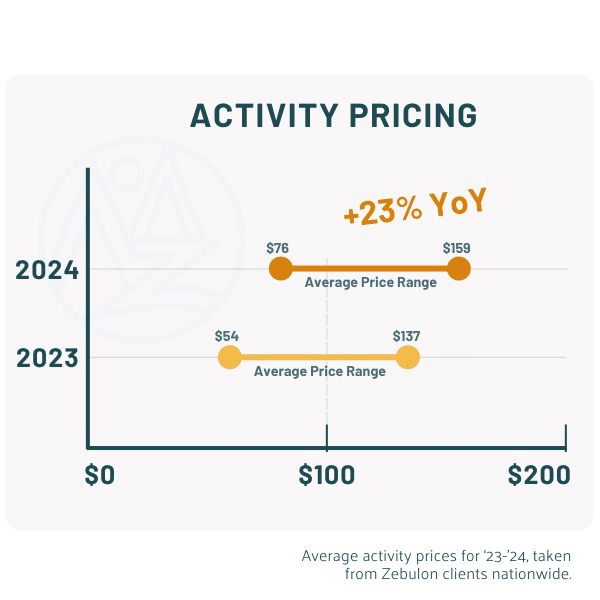

In terms of pricing, we’re expecting our clients to increase activity prices by $22 per passenger on average, which is a 23% increase over 2023. This means average outfitter activity prices for 2024 are ranging from $76 to $159 per passenger. The vast majority of these activities are half-day whitewater and zipline tours. Important note: these numbers are the national average for our Eddy clients, and pricing most certainly varies by region.

The number of passengers booked in Q1 ‘24 is down 7% compared to the same period in 2023. But, because of Zebulon’s suggested increases in price per our pricing consults, activity dollars are actually up 12% YoY! That means mo’ money in bank accounts leading into the costly pre-season prep months.

Activity Revenue

Across all our outfitting clients, we’re still expecting to drive an additional $1.3m revenue for the 2024 season. This is cautiously considering each client’s projected drop in passenger numbers and anticipated pricing changes above, representing a 13% cumulative increase over 2023.

That projected $1.3m divvies up into an additional $259k in activity revenue, on average per Zebulon client, over 2023’s numbers. Of course, if passenger volume rebounds, revenue numbers will be closer to our targets stated below. Fingers crossed!

A Note on Pricing Adjustments

We heavily scrutinize every trip’s value proposition and operating costs, together with each of our outfitting clients. We then adjust prices accordingly, to maximize customer satisfaction and profitability. We set each trip’s price based on key variables including booking data and our professional judgment. The numbers don’t lie, and it’s worked well for our clients so far!

If you’re interested in a similar hands-on price consultation for your outfit, let us know.

Revenue & NOI Increases

We have a habit of setting ambitious goals with our clients. We also have a track record of meeting or exceeding those targets year over year.

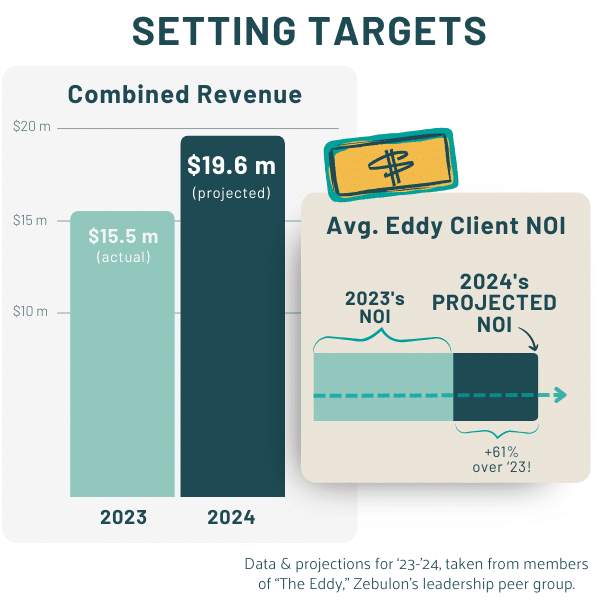

All Eddy members brought in a combined $15.5 million in total revenue in 2023, which includes activity, lodging, retail, photos, fee income, and more. Collectively, we set targets for them to bring in $19.6 million over the 2024 season. Individually, that means we’re shooting for about $680k more revenue for each client.

What’s even more indicative of the health of these outfits? Given our pricing adjustments and service refinements, we project these Eddy members’ target Net Operating Incomes to come in a whopping 61% over their 2023 numbers.

For those of you keeping score, that’s an average of $497k more NOI, or almost a half-milly in profit each. *Whistles*

Non-Eddy Contributors:

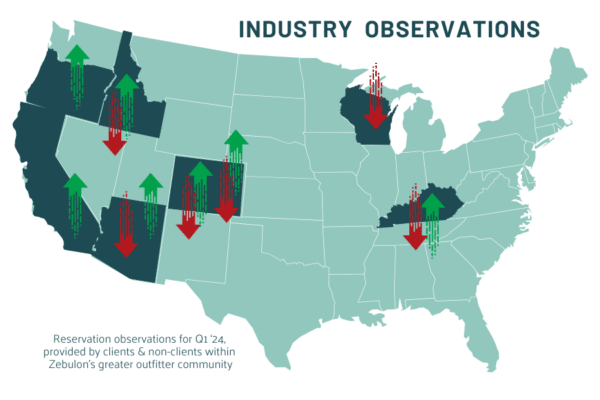

As mentioned above, we solicited Q1 ‘24 data from others outside our Eddy group for this 2024 Scout Report. Our community’s responses are in line with our “mixed bag” theory. Here’s a rundown of their data.

We received responses from outfitters in Colorado, the Pacific Northwest, the Southwest, and the Southeast.

In Colorado, one outfitter is down in both customer base and preseason bookings. Another Colorado outfit is seeing a significant increase in both the quantity of passengers and revenue. In the Pacific Northwest, about half of the rivers and activities are outperforming 2023’s numbers, whereas the other half are underperforming – a total mixed bag. In the Southeast, activities and lodging are both down respectively, but thanks to pricing adjustments, income is up overall. And finally in the Southwest, passenger volume has dipped significantly compared to 2023.

An important observation from many collaborators is a general trend toward walk-ins and last-minute bookings. This is in line with our prediction that activity bookings will (eventually) follow lodging bookings. So, our advice is to do the necessary legwork to prepare your outfit for walk-ins or last-minute bookings.

Another important note: Many of the largest fluctuations our industry members are seeing are attributed to unseasonable weather in 2023. This includes floods, droughts, and everything in between, which significantly impacted outfitters’ abilities to operate excursions. Weather is almost always unpredictable.

As one of our Eddy clients put it, after over 40 years in this industry, he still hasn’t seen a “normal” weather year yet – so don’t hold your breath!

Key Takeaways

The long and short of it is (if you haven’t caught on by now): 2024 is a mixed bag. But, overall, this is a positive thing. If we were projecting doom-and-gloom numbers across the board, you’d be the first to know.

Generally, advanced activity bookings are down slightly from 2023. However, lodging is performing better than activities, and lodging nights in 2024 might even outperform 2023’s numbers in the end.

In my opinion, these activity and lodging trends are indicative of pre-pandemic purchasing behavior. Which itself is indicative of a return to normalcy.

Remember: Before the pandemic, recreational travelers would book their lodging well in advance. But, they’d wait until closer to their travel dates to book activities and excursions. This tendency was thrown out the window with the arrival of the Pandemic, because distancing rules and an utterly chaotic boom in passenger numbers meant an increased need to book activities well in advance – or risk not getting a space at all.

I’m hopeful activity bookings will catch up to lodging bookings by the end of the summer season. The pre-booking time period for activities may shrink in 2024. But, if the lodging numbers we’re seeing are any indication, there will still be plenty of outdoor adventure enthusiasts ready to pay for your excursions this summer.

The Bottom Line

The one constant we’re seeing, despite the mixed bag “March Madness” regarding the volume of passenger bookings, is most outfits’ booking dollars are up from 2023. Many attribute this to Zebulon’s pricing presentations at industry conferences and one-on-one pricing consults, and this is true for both non-clients and clients alike.

Remember, establishing an intentional pricing strategy will have a long-standing, multi-year positive effect. As another of our Eddy members says, “I sleep easier knowing my competitors are leaving money on the table.”

Did this 2024 Scout Report miss any trends you’re noticing? Drop us a line here. Want early access to our in-depth data and Zebulon’s real-time insights? Want to expedite the growth of your outfit in a non-competitive environment shared with other outfit owners and leaders? Contact us today about joining The Eddy and getting on retainer with Zebulon.