‘Tis the season!

Each year, between when Q1 wraps up and before the summer season gets into full swing, Zebulon publishes our Scout Report.

In these reports, we show highlights of the data we’ve amassed, and we make crazy-accurate predictions for our clients as well as the greater industry.

Read on for our full 2025 summer scout report.

The Devil is in the [Data] Details

The star player in this year’s scout report is our Central Data Hub, which we’ve painstakingly designed to pull all of our outfits’ distinct data sources into useful, relevant, and easily understandable visuals. All the visuals below feature screenshots pulled directly from our Central Data Hub.

It’s important to highlight our in-house data whisperer, Kayla, who puts in countless hours each week ensuring we get accurate weekly reports from our clients’ respective data sources!

Our Central Data Hub compiles data from over two dozen unique data sources, including various ResTechs (like FareHarbor), POS systems (like Square), and financial platforms (like QBO).

The Big Picture: Let the Data Do the Talking

Mid-April 2025, we hosted a special data-centric Groover Gab+ session to reveal our season predictions. We had a massive turnout, and we’re grateful to our outfitter community for showing up and collaborating!

We kicked off the Groover Gab+ data session by looking at a handful of bigger-picture economic indices to discuss the broader economy at large: unemployment rate, disposable income, and the consumer confidence index.

- As of March 2025, unemployment was a healthy 4.2%

- Disposable income in 2024 clocked in at about $51.5k per capita, up from 2023’s $50.5k per capita

- The March 2025 consumer confidence index settled in at 92.9 points. (However, we reminded attendees that the Consumer Confidence Index is calculated from a very subjective survey distributed to a tiny number of households each month – it’s basically a “vibe check,” and it’s safe to say Zebulon takes the CCI’s numbers with a big grain of salt!)

Sources for the bullet points above (which include some of our favorite and most reliably consistent data sources), include: data-explorer.oecd.org, census.gov/economic-indicators/, fred.stlouisfed.org, and bls.gov. These are free, easily accessible sources that provide honest data despite however turbulent other sources may make you feel.

The Zebulon-Sized Picture: We’ve Reached our “New Normal”

The long and short of it: It appears that 2024 was our industry’s final post-pandemic year of dropping numbers (yay!). The 2025 numbers, whether it be passengers booked or lodging nights reserved, are crushing 2024 and even on-track to exceed 2023.

Our evidence for reaching the “new normal” is how well month-by-month bookings mirror previous years. This observation is echoed by data published at Inntopia, a paid-for subscription we retain in our efforts to keep a pulse on the broader mountain-destination tourism industry.

As Kayla observed during one internal meeting recently, the MoM (month over month) pre-season sales numbers from 2023 to 2025 are so close “they look made up.” But we promise you, they’re not!

Before the height of the 2024 summer season, we were seeing pre-pandemic purchasing behavior, itself indicative of a return to normalcy. Although the full 2024 season came in slightly lower than 2023, all signs are pointing to 2025 being stronger than 2024 industry-wide, and perhaps even than 2023.

Elephant? What Elephant?

We want to address one elephant in the room: Economic uncertainty.

Assuming nothing drastic happens between now and Labor Day Weekend (i.e. a tariff-caused global collapse, or World War III), things should stay-the-course for a strong summer season. Our recommendation: Stay diligent, and trust the numbers.

2025 Pre-Season Sales Performance

Generally, we’re seeing that 2025’s sales are outperforming both 2024 and 2023. Volume levels, or the number of passengers and room nights booked, dipped slightly below the previous two years in February ‘25, but rocketed back up to take the lead in March ‘25. April is lagging slightly, maybe due to all the “doom and gloom” tariff and stock market noise, but not by an alarming amount.

Purchase Date

The period from November ’24 through Mid-April ’25 brought in $2.7m collective sales for Zebulon’s clients on retainer, which is up a healthy $460k and 19% over the same period the prior year. Our clients also booked nearly 8,700 passengers during this period (Nov.1-Apr.13), which is up 18% from the same period.

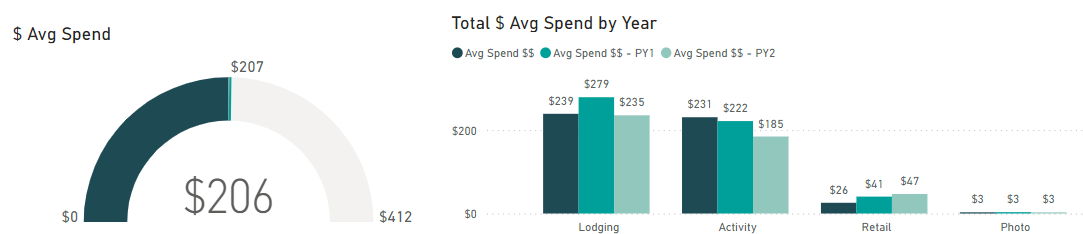

Pricing

It seems we can’t talk about sales without prices rearing their head. So, during the live session, we shared data and entertained questions about pricing. From November until Mid-April, the aggregated spend per item is on-par with last year. However, activities are the one golden egg customers continue to spend more money on per unit.

Webinar Attendee Comments and FAQs

During the live event, we sourced polls, comments, and questions from our audience. Some key takeaways sourced from over 30 outfitters in the April ‘25 Zoom included:

- 71% of attendees noting their 2025 sales are already performing better than 2024

- 67% of attendees indicating they expect their 2025 revenue & activities to be about the same or better than 2024 (with only 33% predicting ‘25 revenue & activities to clock in lower than ‘24)

- Reinforced sentiment about shrinking lead times, AKA the number of days between when an activity is purchased and when the trip takes place. Folks are booking trips less far in advance these days, for better or worse.

The Value of Attending Our Live Sessions

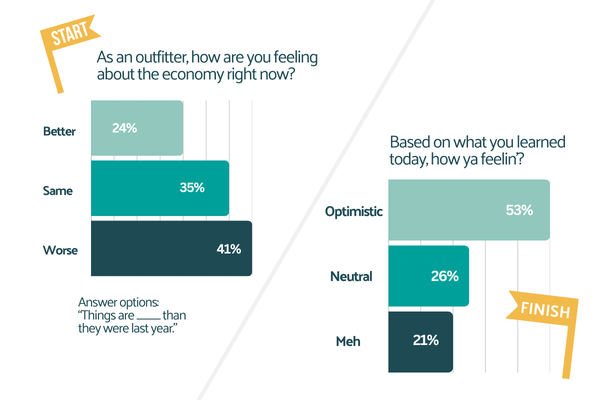

We kicked off the Groover Gab+ session with a “vibe check” – by polling attendees how they’re feeling about the economy in mid-April 2025. To nobody’s surprise, sentiment leaned toward feeling like the economy is worse in 2025 than it was in 2024.

However, we wrapped up our data share with one final “last look” poll, asking “Based on what you learned today, how ya feelin’?” And wouldn’t ya know it, sentiment had flipped 180 degrees! Over half of respondents said they’re feeling optimistic and ready to “send it” for the upcoming season.

This just goes to show the power of showing up in community and letting the data do the talking. We can’t stress enough how fun and informative our sessions are – you really can’t afford to miss the next one! Sign up for our future Groover Gabs here.

The Key to Our Success: Staying Future-Focused

We’ll say it again: It appears that 2024 was our industry’s final post-pandemic year with dropping numbers. The 2025 industry numbers we’re seeing are either on-par with 2023 or, in the case of Zebulon’s clients in particular, performing better.

This is because, here at Zebulon, we have a habit of looking to the future and setting ambitious goals with our clients. We also have a stellar track record of meeting or exceeding those targets year over year.

We attribute our success to our hand-crafted recipe. First, we carefully calculate operational targets together with our clients, based on the owner’s and key manager’s individual goals for their outfits. Then, we track progress toward those goals by looking ahead to the future, and carefully recalibrate as each week of each season progresses. We consciously choose not to dwell on the past, and we help our clients keep their eyes on the prize.

Thanks to our obsession for staying future-focused, our clients historically outperform the larger outfitting industry!

Build a Bridge Off Your Island with The Eddy

We hear it over and over again: “I feel like I’m on an island.”

If you and your team feel isolated as rural outfitters, and could use a business pick-me-up from your fellow outfitting peers, our Eddy leadership peer group is without a doubt your most powerful asset.

In addition to enjoying year-round data share sessions where we look at each outfit’s performance in detail (from sales, to return on promo spend, to overhead deep-dives), we also deliver an MBA-caliber curriculum that’s specifically designed for seasonal, outdoor businesses.

Remember, The Eddy is a supportive, non-competitive environment, so members thrive by sharing numbers and discussing solutions together!

If you’re ready to build a bridge off the “rural outfitter” island you’ve been stranded on, then you’ve absolutely got to join The Eddy.

Did this 2025 Scout Report miss any trends you’re noticing? Drop us a line here. Want exclusive access to our in-depth data and Zebulon’s real-time insights? Want to work on your business from the inside out, in a non-competitive environment made up of other outfit owners and leaders? Contact us today about getting on retainer with Zebulon.